When you Homestead your property, you are claiming the property as your primary domicile. Which means this is the property you own, occupy, register your driver's license, file taxes, vote, receive mail, etc.

- The exclusion reduces the taxable market value of qualifying homestead properties. By decreasing the taxable market value, net property taxes are also decreased.

- The program can also qualify you for other programs such as the disabled veterans market value exclusion, senior citizens property tax deferral, and property tax refund.

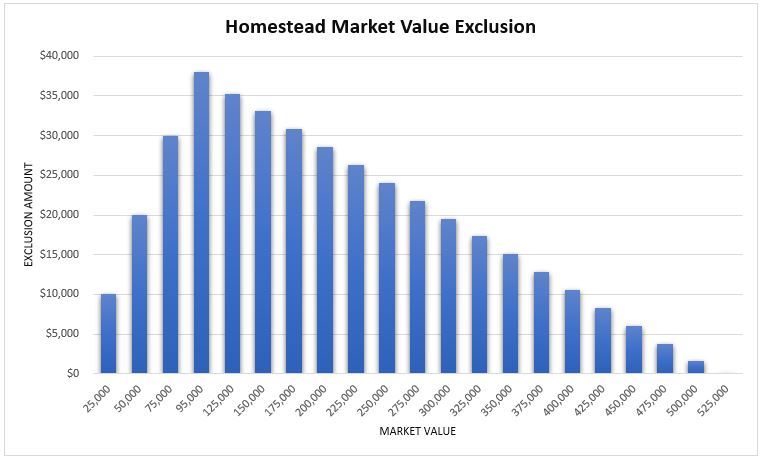

**For the 2024 assessment year and beyond the maximum exclusion amount has increased from $413,800 to $517,200. (Updated HMVE graph below)

** Property taxes payable in 2024 are still going to be calculated using the maximum exclusion of $413,800 per MN state statute, 273.13, subdivision 35.

For homesteads valued at $95,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $38,000. The exclusion is reduced as property values increase and phases out for homesteads valued at $517,200 or more. Properties that are partial homesteads (for example, when only one of two owners lives there) will have a reduced exclusion.